Investing in silver bullion is a popular way to diversify one’s portfolio and hedge against inflation. For those interested in adding this precious metal to their investment mix, there are numerous options available. Below, we highlight the five best types of silver bullion that are considered prime choices for investors:

1. **Silver Coins** – Government-minted silver coins are a favored choice among investors due to their legal tender status, which adds an extra layer of security and trust. Notable examples include the American Silver Eagle, Canadian Silver Maple Leaf, and the Austrian Silver Philharmonic. These coins are not only valuable for their silver content but also for their collectability and aesthetic appeal.

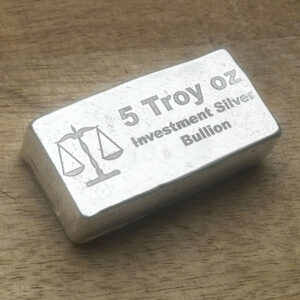

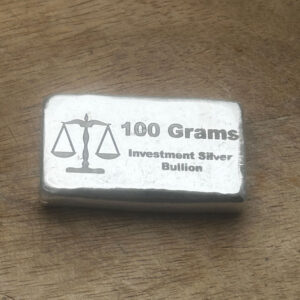

2. **Silver Bars** – Silver bars are a staple for investors looking for a straightforward, no-frills approach to owning physical silver. They come in various sizes, from 1 ounce to 1,000 ounces, offering flexibility in investment amounts. Renowned refineries such as Engelhard, Johnson Matthey, and the Royal Canadian Mint produce bars with .999 or higher purity, making them a reliable asset.

3. **Silver Rounds** – Similar in appearance to coins but not legal tender, silver rounds are produced by private mints and typically carry lower premiums over the spot price of silver than coins. They are available in a variety of designs, often celebrating themes from history, culture, or nature, and are a cost-effective way to accumulate high-purity silver.

4. **Junk Silver** – The term “junk silver” refers to pre-1965 US coins that contain 90% silver, such as dimes, quarters, and half dollars. These coins are sought after for their silver content rather