Silver offers several compelling advantages as an investment choice compared to gold. Here are some reasons why you might consider stacking silver instead of, or alongside, gold:

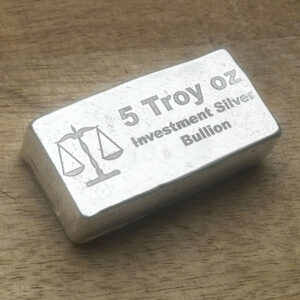

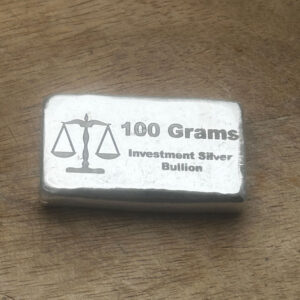

1. **Affordability**: Silver is significantly less expensive per ounce than gold, making it more accessible to small-scale investors or those just starting out. This lower price point allows for the purchase of more physical silver, increasing the potential for a diversified tangible asset portfolio.

2. **Higher Industrial Demand**: Silver has a wide range of industrial applications, from electronics to solar panels, due to its excellent conductive properties. This industrial demand can drive the price of silver up, potentially offering greater returns on investment compared to gold, which is less consumed by industry.

3. **Greater Price Volatility**: Silver prices are known to be more volatile than gold. While this may seem like a risk, it also presents opportunities for investors to buy low and sell high, potentially yielding a substantial profit margin.

4. **Gold-to-Silver Ratio**: Historically, the ratio of gold to silver prices has fluctuated, and some investors analyze this ratio to determine the relative value of each metal. When the ratio is high, silver may be undervalued compared to gold, suggesting a good buying opportunity for those looking to invest in silver.

5. **Tangible Asset**: Like gold, silver is a tangible asset that can provide a hedge against inflation and currency devaluation. It’s a way to preserve wealth outside of the traditional banking system.

6. **Collectibility**: Silver coins and bars often come in a variety of designs and limited editions, which can add a collectible value over and above the metal content. This aspect can be appealing to those who enjoy the hobbyist